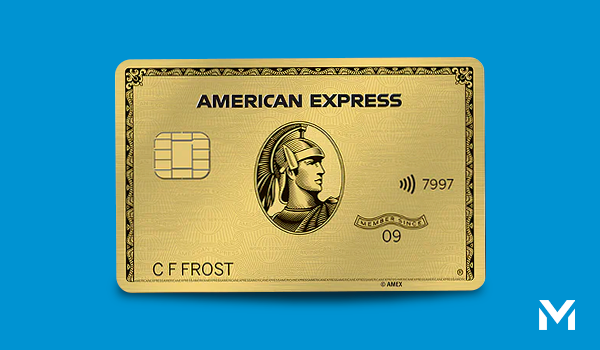

The American Express Preferred Rewards Gold Credit Card is a premium choice for individuals who want to turn everyday spending into meaningful rewards. Whether you’re booking holidays, dining out, or purchasing the essentials, this card transforms routine expenses into Membership Rewards points that can take you further. It’s perfect for those who value flexibility, travel benefits, and a touch of luxury.

What makes this card truly remarkable is how it blends practicality with prestige. With a rich welcome bonus, generous points on all purchases, complimentary airport lounge access, and exclusive entertainment privileges, the Amex Gold Card delivers more than just purchasing power—it delivers experiences. Backed by American Express’ renowned customer service and global reach, it’s a card designed for people who expect more from their credit.

Benefits of the American Express Preferred Rewards Gold Credit Card

1. Substantial Welcome Bonus

Start your journey with a generous Membership Rewards bonus when you reach the required spending threshold within the first few months. It’s an instant head start towards free travel, hotel stays, or gift vouchers.

2. Earn on Every Pound You Spend

For every £1 spent, you’ll earn 1 Membership Rewards point, with no earning cap. Whether you’re buying groceries or paying for a holiday, every purchase brings you closer to rewards.

3. Double Points on Travel

When you book holidays, flights, or hotels through American Express Travel Online, you’ll earn 2 points per £1 spent, helping you accumulate rewards faster.

4. Complimentary Airport Lounge Access

Enjoy two free airport lounge entries each year through Lounge Club membership. It’s a perfect way to unwind before your flight with complimentary refreshments and Wi-Fi.

5. Travel Protection and Peace of Mind

Cardholders enjoy travel inconvenience and accident insurance when paying for trips with their Amex Gold. This includes cover for flight delays, lost luggage, and other travel interruptions.

6. Exclusive Amex Experiences

Gain access to American Express Experiences, offering early ticket access to concerts, theatre performances, dining events, and VIP entertainment opportunities across the UK.

7. Global Acceptance and Recognition

American Express is accepted at millions of locations worldwide, ensuring your Gold Card works just as seamlessly abroad as it does at home.

8. Modern Payment Convenience

Tap and go using contactless technology, or link your card to Apple Pay™, Google Pay™, or Samsung Pay™ for fast and secure mobile payments.

9. Purchase Protection and Extended Warranty

Shop with confidence. Purchases made with your Amex Gold are protected against accidental damage or theft for up to 90 days, and qualifying items include an extended warranty for extra security.

10. Add Family Members for Free

Share the benefits by requesting supplementary cards for family members at no additional charge, allowing you to earn rewards faster on combined spending.

11. Redeem Rewards Your Way

Redeem Membership Rewards® points for flights, hotels, shopping vouchers, or transfer them to over 12 partner airlines and hotel programmes, including Avios and Emirates Skywards.

12. First-Year Annual Fee Waived

Enjoy all the premium perks without paying the annual fee in your first year, giving you 12 months to explore the card’s full benefits before any cost applies.

Who Can Apply?

To be eligible for the American Express Preferred Rewards Gold Credit Card, you must:

- Be 18 years of age or older.

- Be a UK resident with a permanent address.

- Hold a current UK bank or building society account.

- Have a fair to excellent credit rating.

- Earn a minimum of £20,000 annually or demonstrate sufficient income to meet repayments.

- Agree to pay the annual fee after the introductory year (currently £195).

How to Apply

- Go to the official American Express UK website.

- Navigate to the Preferred Rewards Gold Credit Card page.

- Click on “Apply Now.”

- Complete the application form with your personal and financial details.

- Review the interest rates, fee structure, and terms of use.

- Submit your application for immediate review.

- Most applicants receive a quick decision online.

- Once approved, your card will arrive by post within 5–10 business days.

- Activate your card online or via the Amex app.

- Start earning Membership Rewards® points right away.

Frequently Asked Questions (FAQ)

1. Is there an annual fee for this card?

Yes, an annual fee applies after the first year. The initial 12 months are free of charge.

2. How can I earn points?

You’ll earn 1 point for every £1 spent, with double points when booking through American Express Travel Online.

3. Can I transfer my points to airlines?

Yes, you can transfer them to airline partners such as Avios, Virgin Atlantic, Emirates, and many others.

4. Is travel insurance included?

Yes, you’ll receive complimentary travel accident and inconvenience insurance when you use your card to pay for travel.

5. Can I use my card abroad?

Yes, American Express is accepted at millions of merchants around the world.

6. What is the welcome bonus?

New members can earn a substantial points bonus after meeting the spending target within the introductory period.

7. Can I add supplementary cardholders?

Yes, additional cards can be issued at no extra cost, allowing shared benefits and faster point accumulation.

8. What happens if I don’t pay my balance in full?

Interest will apply, and you could lose your interest-free grace period—so it’s best to pay in full each month.

9. Does it work with contactless and mobile wallets?

Yes, it supports Apple Pay™, Google Pay™, and Samsung Pay™.

10. How do I manage my account?

You can monitor spending, track rewards, and make payments easily through the Amex website or mobile app.

11. How long is the interest-free period?

You can enjoy up to 56 days of interest-free credit if you pay off your balance in full each month.

12. What credit score is needed?

Applicants generally need a fair to excellent credit score to qualify for approval.

How to Maximise the Value of the M&S Transfer Plus Mastercard <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Learn how to genuinely use this balance transfer credit card to cut interest costs while squeezing as much value out of it as possible. </p>

How to Maximise the Value of the M&S Transfer Plus Mastercard <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> Learn how to genuinely use this balance transfer credit card to cut interest costs while squeezing as much value out of it as possible. </p>  Deep Dive Into the Amazon Barclaycard Visa: Real Value or Just a Niche Perk? <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> An in-depth guide to maximizing this Amazon-branded credit card and how it compares in real-world usage. </p>

Deep Dive Into the Amazon Barclaycard Visa: Real Value or Just a Niche Perk? <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> An in-depth guide to maximizing this Amazon-branded credit card and how it compares in real-world usage. </p>  Advanced Guide to the Fluid Credit Card: Maximising Your 0% Balance Transfer Window <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> A comprehensive look at how to use the Fluid Card effectively, avoid costly mistakes, and evaluate smarter alternatives for UK consumers. </p>

Advanced Guide to the Fluid Credit Card: Maximising Your 0% Balance Transfer Window <p class='sec-title' style='line-height: normal; font-weight: normal;font-size: 16px !important; text-align: left;margin-top: 8px;margin-bottom: 0px !important;'> A comprehensive look at how to use the Fluid Card effectively, avoid costly mistakes, and evaluate smarter alternatives for UK consumers. </p>